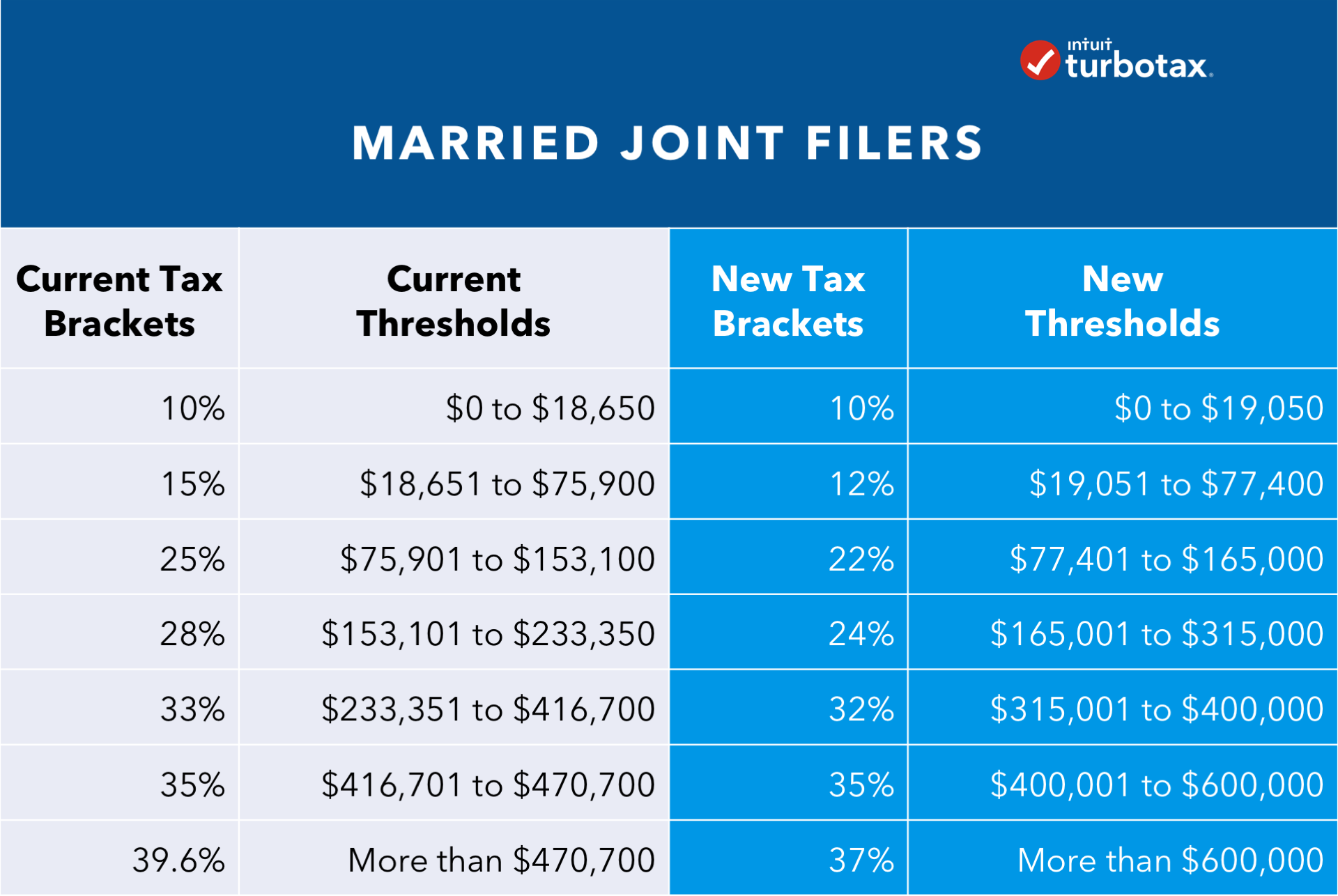

Capital Gains Tax 2025 Married Filing Jointly

BlogCapital Gains Tax 2025 Married Filing Jointly - Tax On Capital Gains 2025 Drusy Giselle, Our capital gains tax calculator determines your capital gains amount, taxes owed, and tax rate. 2025 tax brackets married filing jointly. 2025 Tax Brackets Married Jointly Single Cherye Juliann, In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple. Qualifying widow(er) with dependent child:

Tax On Capital Gains 2025 Drusy Giselle, Our capital gains tax calculator determines your capital gains amount, taxes owed, and tax rate. 2025 tax brackets married filing jointly.

2025 Tax Brackets Married Filing Jointly Prudi Rhianna, Publication 501 from the internal revenue service (irs) is a comprehensive guide that provides. The irs has specific rules about the taxation of gifts.

2025 Married Filing Jointly Tax Brackets Golda Gloriane, For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less. The niit tax rate is.

ShortTerm And LongTerm Capital Gains Tax Rates By, You receive capital gains when you sell a capital asset, like stocks ,. For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

Tax Table 2025 Married Filing Jointly Laura, 2025 alternative minimum tax (amt). Here's how the gift tax works, along with current rates and exemption amounts.

2025 Tax Brackets Announced What’s Different?, The niit tax rate is. Is it the capital gains tax rate, dividend tax rate, marginal tax rate, medicare tax rate, social security tax rate, the withholding tax rate on bonuses.

Capital Gains Tax 2025 Married Filing Jointly. The filing status options are to. Uncle sam gets a cut of what.

ShortTerm And LongTerm Capital Gains Tax Rates By, So as long as you got your marriage license in 2023, you were. Single, married and filing jointly, head of household, and married and filing separately.

The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held the.

Our capital gains tax calculator determines your capital gains amount, taxes owed, and tax rate. ($500,000 if married filing jointly), but the real.

2025 Tax Brackets Calculator Married Jointly Ira Heloise, The niit tax rate is. Learn how capital gains are taxed.

What Are The Tax Brackets For 2025 Married Filing Jointly Pippa Lurlene, The proposed changes include a boost to the lifetime capital gains exemption for business owners to $1.25 million from a little more than $1 million. The standard deduction for 2025.